OneService APP Welcome Offer

Promotion Period: 10 November to 31 December 2025

Download and register on OneService APP

to enjoy an unprecedented digital insurance experience!

Newly registered users during the Promotion Period

may receive a HK$25 coffee e-Gift voucher!

Digital insurance at your fingertips

China Life (Overseas)’s OneService APP offers an optimized interface with upgraded user experience. Simply log in to our APP to access your policy coverage and enjoy up to 24 online policy services all in one place. You can manage your policy effortlessly anytime, anywhere, bringing you an unprecedented digital experience!

Easy and secure login

Register/login using your mobile number or email. No need to remember any username

Quick access to policy coverage

Promptly access to all the information you need and stay informed of your policy benefits

Self-service policy management

Choose from a diverse range of up to 24 online policy services

Convenient claims services

Estimate claimable amount, apply for direct billing service and make claims in just a few simple steps

Overview of key features

New policy services

- Policy contract acknowledgement

View coverage details

- View coverage details and policy value

- View policy contract

- View e-statements, notifications and letters

Manage your policy

|

Change of policy information |

1.Change of mobile/email 2.Change of address and other phone number 3.Change of personal information (including name of policyholder, name of insured and marital status etc.) 4.Change of identity document/nationality 5.Self-certification (Common Reporting Standard) |

|

Withdrawal of policy value |

6.Change of payment options (including accumulation with interest, cash payment and premium payment etc.) 7.Change of default payment account 8.Policy loan 9.Withdrawal of policy value 10.Application of policy maturity benefit payment |

|

Renewal premium payment |

11.Change of premium payment options (monthly, quarterly, semi-annual or annual) 12.Setup autopay service 13.Resume/cancel autopay service 14.Pre-paid premium and premium levy |

|

Change of roles in the policy |

15. Appointment / change / termination of contingent policyholder 16.Change of policyholder 17.Change of beneficiary appointment 18.Designation/change/termination of contingent insured |

|

Change of policy coverage |

19.Policy reinstatement 20.Deletion of riders 21.Reduction of sum assured/basic amount 22.Policy surrender/cancellation |

|

Others |

23.Repayment 24.Bankruptcy discharge |

Claims services

| Want to estimate costs before receiving medical treatment? |

Want to apply for hospitalization direct billing before receiving medical treatment? |

Want to submit claims or reward application? |

| “VHIS Claimable Amount Estimator” can provide quick estimate of the claimable amount1 |

If hospitalization is required, simply submit “Hospitalization Direct Billing Pre-approval Application” to us in advance and once approved, you won’t have to pay medical expenses out of pocket upon discharge2, allowing you to focus on treatment and recovery. From application submission to tracking progress and downloading notifications, everything can be handled online in one stop! |

Submitting claims is just a few simple steps away. You can also track the claims status, download notifications and receive e-statements at every step of the process. For medical receipt of HK$10,000 or below, it is not required to mail back the original copy3 |

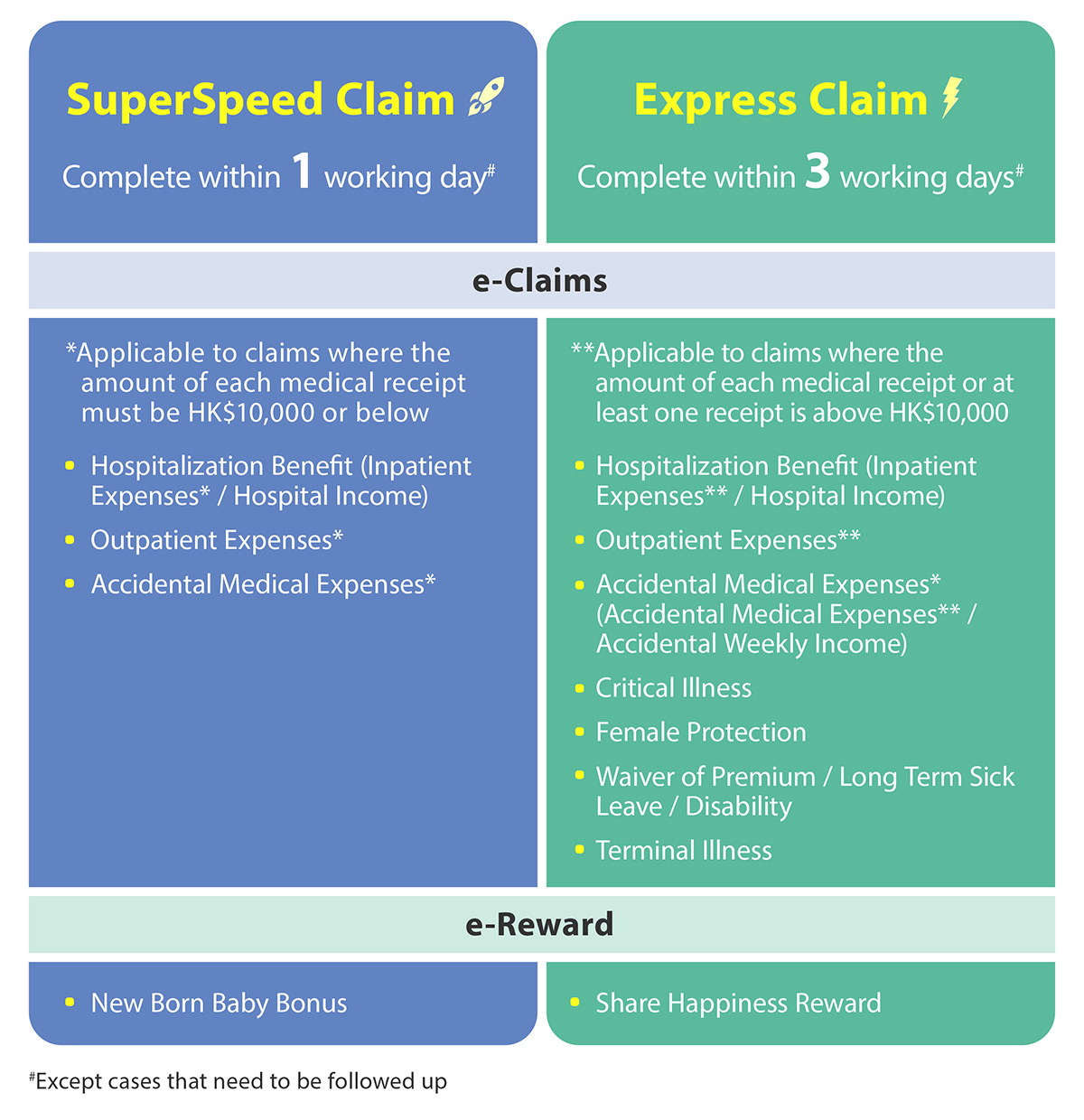

OneService APP supports diverse claims and reward applications

Notes:

- The claimable amount estimate is just for reference and will not constitute final liability of the Company. Claim decision will depend on the submission of all supporting documents as required for claim assessment in accordance with the policy terms and conditions and benefit entitlement in the policy year. The final claimable amounts and out-of-pocket expenses will be subject to the actual bill amounts and breakdowns as stated in the official receipts issued by hospital or clinic. The claimable amount estimate is subject to benefit reduction or limitation in relation to the regions where the eligible medical services are incurred or the choice of higher ward class. The claimable amount estimate is based on the benefit limit of the insured's policy. Any pending claim yet to be approved or any exclusion will not be taken into account for the estimation.

- Subject to policy terms and conditions and claims amounts.

- The Company will request the original medical receipts and documentation related to the claims application (“original copy”) to be submitted for verification within 180 days upon completion the entire claims process or within any specified period.

OneService APP Welcome Offer – Terms and Conditions:

- OneService APP Welcome Offer (the “Activity”) is organized by China Life Insurance (Overseas) Company Limited (“China Life (Overseas)” or the “Company”). By participating in the Activity, participants agree that they have read and agreed with the terms and conditions herein (the “T&C”).

- The Activity is open to all individuals who fulfill all of the requirements (the “Eligible Participants” or “Customers”) below:

(a)any customer who has inforce individual insurance policy issued by the Hong Kong Branch of China Life (Overseas);and

(b)the customer has attained the age of 18 or above at the time of entry to the Activity. - The promotion period of the Activity is from 10 November 2025 to 31 December 2025 (both dates inclusive) (the “Promotion Period”).

- Eligible Participants who newly registered OneService APP during the Promotion Period will be entitled to a HK$25 coffee e-Gift voucher (the “Offer”). The Offer is available on first-come-first-served basis, while stocks last.

- All Eligible Participants will be automatically enrolled to the Activity. Regardless of the number of in-force individual policies held, each Eligible Participant will be entitled to the Offer once only.

- Eligible Participants who newly registered OneService APP will receive an Offer notification email. The Offer will be distributed to customers via OneService APP within 30 working days from the completion of the Activity.

- At the time when the Customer redeems the Offer, subject to China Life (Overseas) records, he/she must have inforce individual insurance policy, otherwise he/she will be disqualified without further notice.

- In any event, the Offer cannot be exchanged, redeemed for cash or resold.

- China Life (Overseas) will not re-issue or replace the Offer in the event of any loss, damage or expiry of the Offer after redemption.

- China Life (Overseas) is not the supplier of the Offer. China Life (Overseas) shall not be liable for the redemption and usage of the Offer. For any dispute about the Offer, the Customers must settle directly with the supplier. Usage of the Offer is subject to the terms and conditions stipulated by the supplier. Please refer to the terms and conditions set out in the Offer.

- China Life (Overseas) reserves the right to amend all or part of the terms and conditions of the Activity at any time without issuing further notice. In the event of any disputes arising from or in connection with the Activity, China Life (Overseas) shall have absolute discretion in making a final decision.

- Except for China Life (Overseas) and the Customers, no other person or entity shall have any rights under the Contracts (Rights of Third Parties) Ordinance (Chapter 623 of the laws of Hong Kong) to enforce any of the T&Cs.

- The T&Cs are governed by and must be construed in accordance with the laws of the Hong Kong Special Administrative Region. In the event of any discrepancy between the English and Chinese version of these T&Cs, the Chinese version shall prevail.